Where to Invest in Senior Living

I often get asked exactly where is the best place to invest in the senior living market. People asking already are aware that the market is large and growing, but as they learn more and they decide it’s time to invest they realize that finding the right place to invest has its challenges.

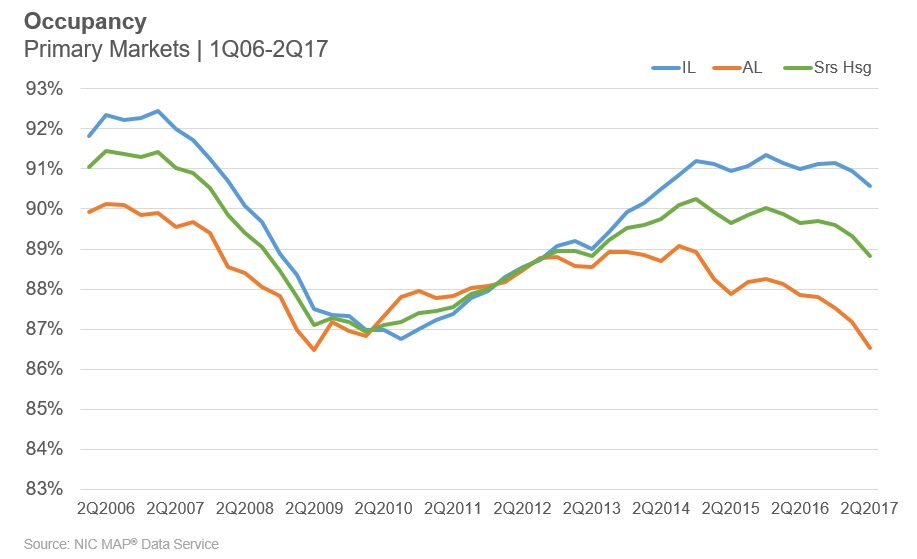

The National Investment Center provides solid data about occupancy over time and as one might expect there are areas of the country where the added supply exceeds the current demand and the occupancy drops. The senior living press has been talking about the current drop in occupancy in assisted living to 88.8%. This makes a potential investor wonder if bad things are happening. The market has its ups and downs:

One can understand the concern about the trends being down. But perhaps it is important to see that it’s been lower in the past and recovered. This chart can also lead one to conclude that investing in IL may be better than investing in AL. That might be true, but as we will see it’s just not that simple. So how does and investor evaluate a specific situation to see if it is the right place to invest?

The Classic Approach

Many investors look at the market opportunities by considering the size and strength of a local market by looking for A, B and C markets. Firms like CBRE report CAP rates by this market breakdown. Some investors will only take on A markets because, among other things, they are raising money from large institutions and foreign investors and they believe that A markets outperform over long periods of time. The data does support this view, but it also means the prices may be higher for those markets. This leads other investors to look for opportunities in B markets. They can buy at lower prices and often these markets are growing nicely. Still other investors will look at C markets to find the opportunity to make a superior return because they competition is weak. The A, B, C market delineation is not black and white and it can be helpful for each investor, but there is not one of these markets that is best for all investors. Acquiring a poorly performing independent living community in a C market and turning it around by running it properly can produce returns in the high teens with little risk. Building brand new, high end community in Manhattan takes a lot of money to pull off, but it also can produce returns in the high teens or low twenties.

Is independent living (IL) better than assisted living(AL)? Or more generally, is one segment of the type of service better than another segment? Looking at the graph above might imply that IL is better. And some further research of data from NIC will show an investor that many IL communities were built more than 15 years ago. For example, looking at recent data from NIC for Orange County shows occupancy for IL at about 91%, but it also shows only two IL communities have been built since 2000 with a total of 315 units. This implies there is a real opportunity to build a new IL. But there is a reason there has been so little added supply of IL. It is hard to find land and to get entitlements in place in Orange County. If you can get over these hurdles then IL is a great investment opportunity in Orange County.

One group of investors acquired a community in a C market that was poorly run and was losing money. The community was across the street from the hospital and was the only senior living provider in town. They converted part of the community from assisted living to skilled nursing so that the offered the full continuum of care with independent living, assisted living, memory care and skilled nursing. And even with over 75% of the residents being covered by Medicaid this community has produced 12% cash returns for years.

There is not necessarily one market (A, B, C) or one type of project (55+, IL, AL, MC or SNF) that is the best place to invest. There is not one service type or combination of service types that is best. Many combinations work. So how does an investor sort the good investment opportunity from the poor opportunities?

Looking to the Hotel Industry

It may be time to look to a more mature industry to see how they structure the products and markets to give a framework for the future investments. Hotels segment their offerings by geography, demographics, psycho-graphics (how person thinks, feels and behaves) and benefits offered by the products. For Hilton, this results in a range of offerings:

| Segment | Examples |

| Luxury | Waldorf Astoria |

| Lifestyle | Canopy |

| Full Service | Hilton, Doubletree, Garden Inn |

| Focused Service | HOME2 |

| All Suites | Homewood Suites, Embassy Suites |

| Vacation Ownership | Hilton Grand Vacations |

This approach goes far beyond A, B, C market types and product services offered to look at many more factors. Just applying this thinking explains why one group looked carefully at buying an existing older 55+ community in a Class A Market in Florida to upgrade it to an independent living community. Upgrading the physical plant and adding a great kitchen and meal plan along with limited activities to raise the value of the community by about 30% within 24 months. There are many 55+ communities in the market and most are old. All the surrounding IL units are full and instead of getting $700 per room per month like a 55+ product, those IL rooms are going for $2200 per room per month. They are changing the benefits offered by the product and targeting a slightly different demographic as well as a slightly higher income level and different psycho-graphic.

Conclusion

The best place to invest is one that fits many criteria. It needs to fit your investment objectives. If you want cash flow in year one that new construction does not work, but the acquisition of a poorly run community can work. A potential investment needs to be in a micro-market defined as a 20-minute drive from the site where the demographics, income, and current supply show that there really is room for the product you will offer. There is not a blanket answer. There is only an answer that comes from understanding all the specifics about your cash flow, your targeted returns, your hold period, the micro-market location, the competition, the income levels and your product and benefits offered. One company had a very successful skilled nursing site and added a new building for memory care only. They struggled as the market would just not fill the memory care units. Did they really do their homework about the market? Or did they just not deliver a quality product at a price point that fit the local market? This should be a sound warning to any investor to ask about the situation until you really understand all the factors for the potential investment. And remember, the operator is critical to your success in every senior living investment.

It is actually a nice and useful piece of info. I’m glad that you simply shared this helpful information with us. Please keep us informed like this. Thank you for sharing.