What We Do For Investors

We work with senior living operators and

investors to ensure profits for both.

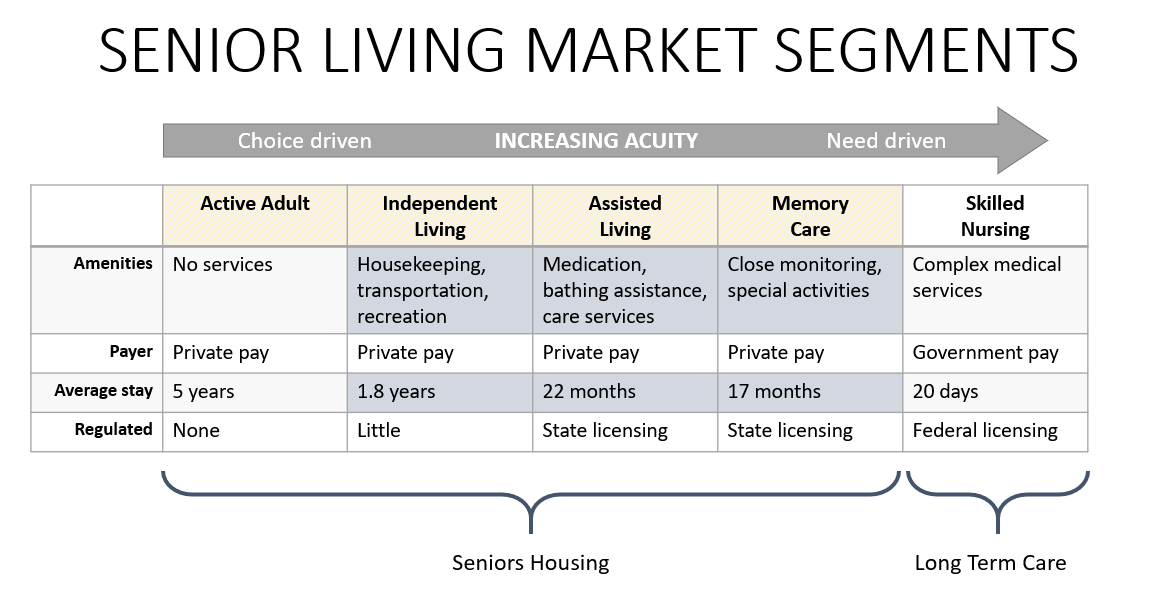

Introduce you to the market size, dynamics and returns

Show you comparisons to other investments

Help you understand the market segments

Why Invest in Senior Living

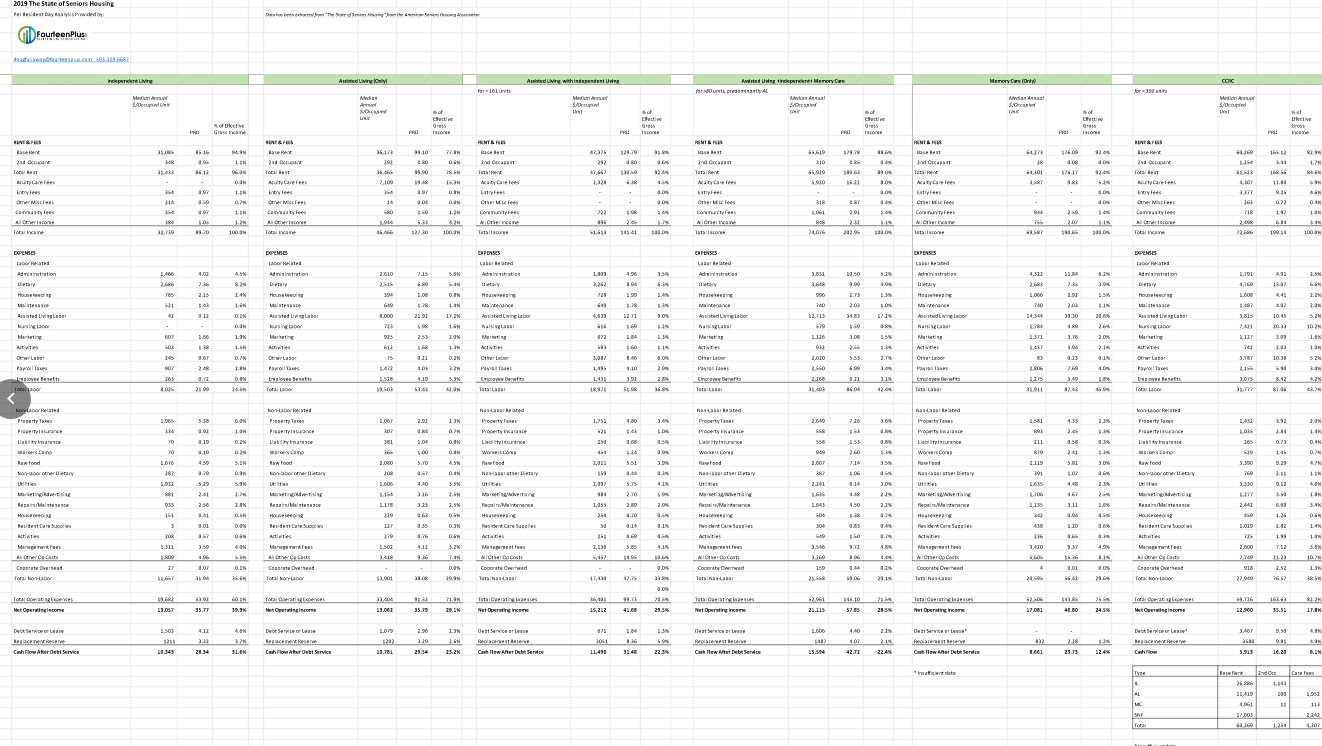

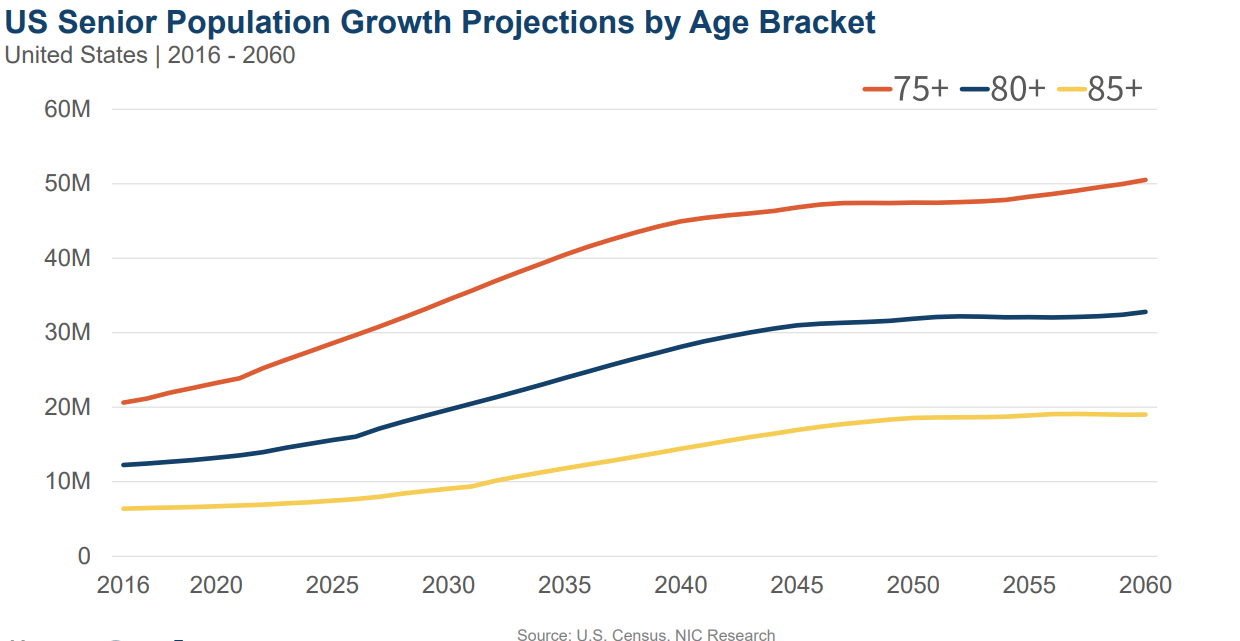

FourteenPlus, LLC connects investors and operators to deliver direct investments in real estate in the $270 Billion U.S. senior living market. Demographics are driving current demand for 1000 new properties per year as there will be 11.5 Million new seniors over 75 years of age by 2030. The returns for the period 2007 through 2017 were 11.2% and exceeded all other real estate property types.

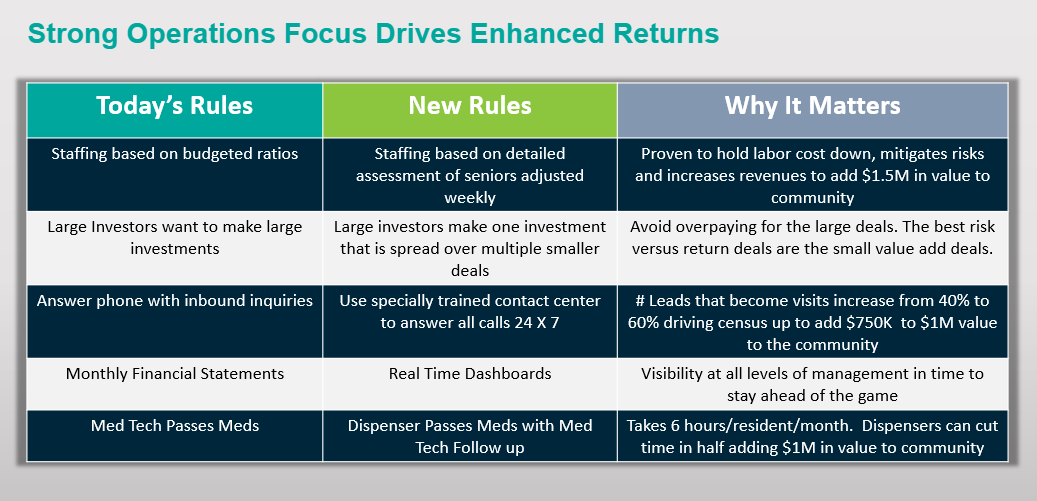

Senior living is a complex business as it is like running a hotel, restaurant, health clinic, and activities center together. Choosing the right operator is critical. The president of FourteenPlus was the CEO of the largest software provider for assisted living, and he knows the superior regional operators. This knowledge provides an excellent deal flow and reduces risk.

The Bottom Line

Whether you are looking for ways to diversify your investment portfolio or getting started in real estate investment, choosing senior housing investment is a smart plan. Senior housing demand stays constant when the economy changes unlike most other types of investments. And the demographics will drive the growth for years to come.

Introduce you to direct investments with proformas you can quickly understand

What We Do For Operators

We work with senior living operators and

investors to ensure profits for both.

Build the Financials to Present So They Get a Quick Answer

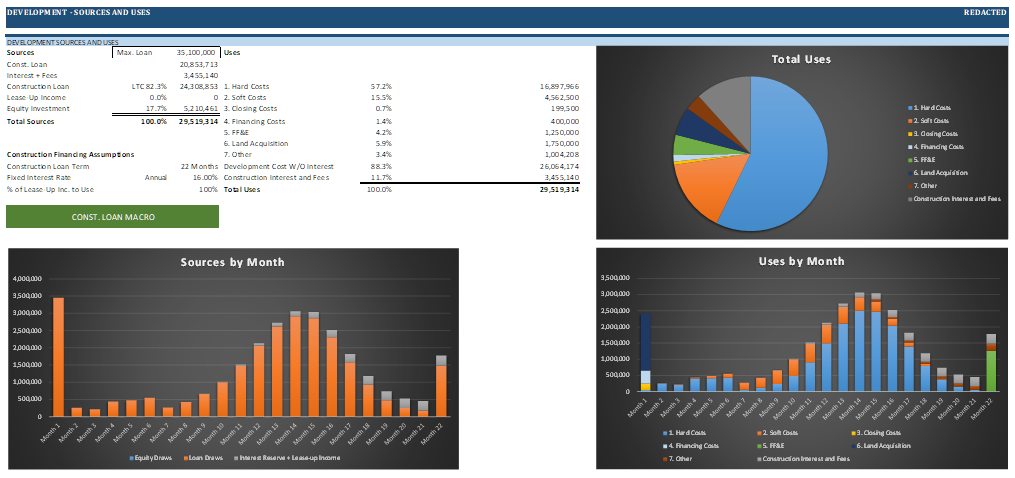

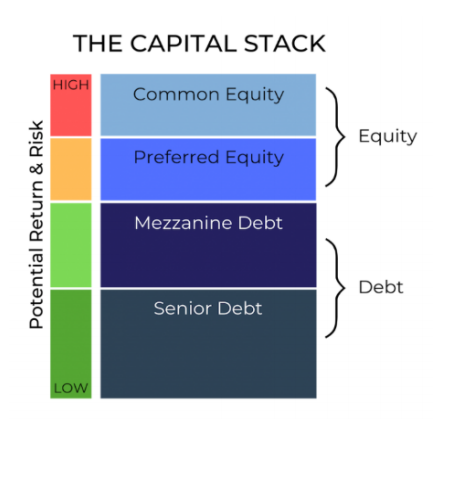

Find the Right Capital Stack

There are many combinations that can be customized to individual operators with the following; Land Loan, GP Equity, LP Equity, Amount of Preferred Return, Tax-Exempt Bonds, Senior Debt from Bank or Dedicated Senior Housing Private Lenders or Institutions, SBA Loans, PACE loans, Mezz Debt, Preferred Equity, General Partner (GP) and Limited Partner LP Equity and more. It all must work for every participant.

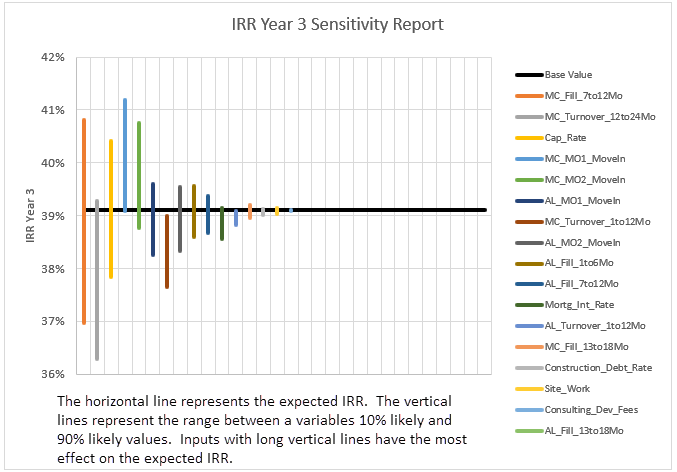

Understand How Project Variables Will Impact Your Returns

Instead of stress testing just a few variables we use Monte Carlo simulation to evaluate the impact of many variables to give you a much deeper understanding. You can communicate with investors to show them with a high level of certainty the returns you are planning.

Understand What Is Driving the Returns

Every project is different, and a Monte Carlo Analysis helps understand which things will make the project fly!

Resources

If you prefer a hard copy please Click Here