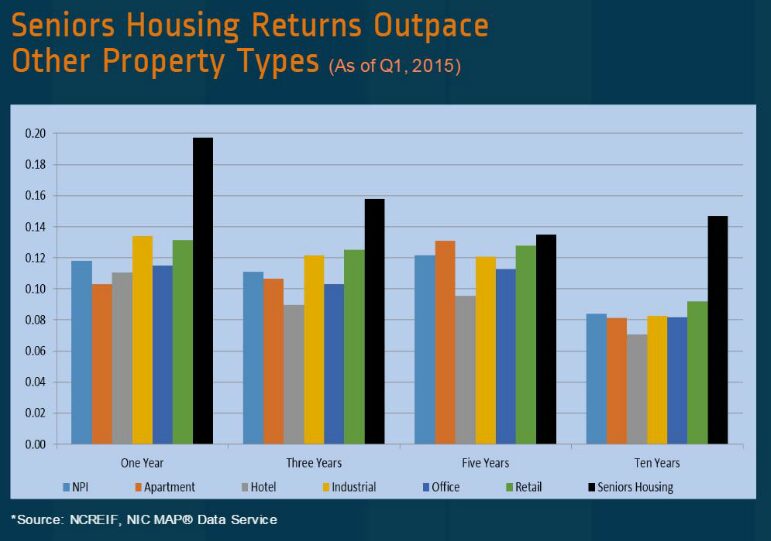

If we look back to 2015, we see great unlevered returns in seniors housing:

No doubt the seniors housing market was the place to invest at least some of your money.

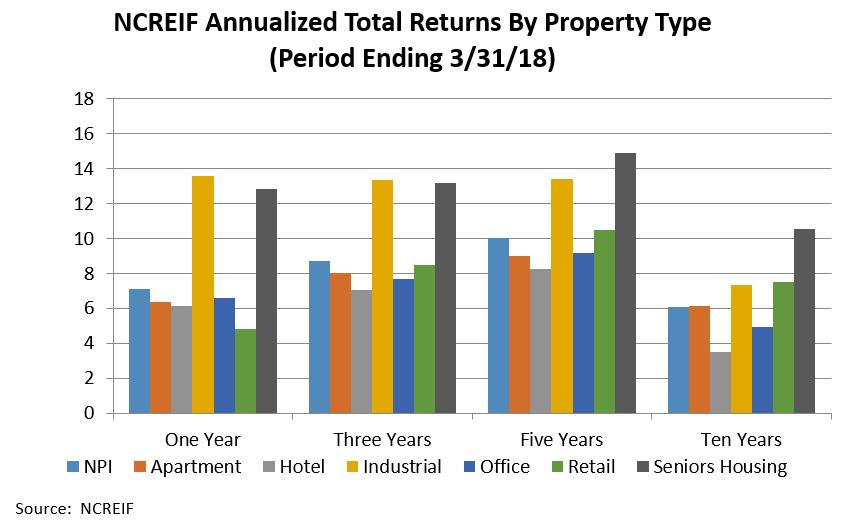

And the world has changed by 2018:

Things changed for several reasons. The world now orders products from Amazon and warehouses are needed to store and move those products, so the Industrial sector grew nicely and provided great returns. But Seniors housing continued to perform.

Which leads us to the question about what is happening today? Here are some examples from deals I am underwriting today:

| Community | Price/Cost | Levered IRR | Average Cash Yield |

| Project 1 – New Build | $22.9M | 48.4% | 13% |

| Project 2 – Value Add | $5.9M | 39.9% | 35.6% |

| Project 3 – Value Add | $6.0M | 22.1% | 27.2% |

Over the coming weeks we will explore this topic further as returns depend on many things- Covid-19, private vs. public investments, etc. The above returns surely indicate seniors housing needs serious consideration to be part of a portfolio.